With the best MACD indicator settings for day trading, you can bring about great changes to your different day trading strategies.

#50 ema and 200 ema strategy download#

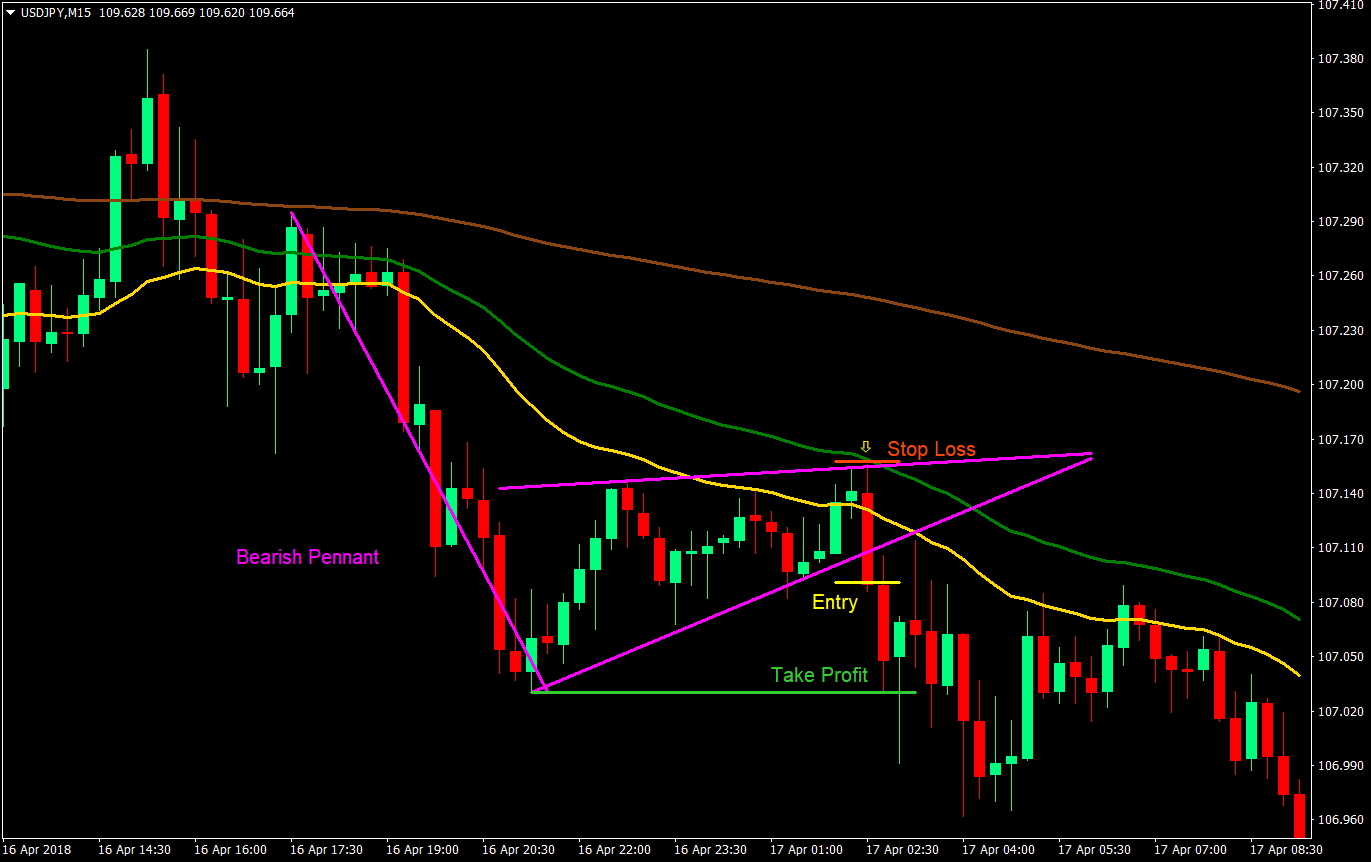

You don’t need to download the MACD indicator separately, as it is already built into the MetaTrader 4 (MT4) platform. To explore what may be a more logical method of trading the MACD divergence, we look at using the MACD histogram for both trade entry and trade exit signals (instead of only entry), and how currency traders are uniquely positioned to take advantage of such a strategy. Trading divergence is a popular way to use the MACD histogram (which we explain below), but unfortunately, the divergence trade is not very accurate, as it fails more than it succeeds. For calculation three moving averages are taken which are 9 day EMA. The MACD is appreciated by traders the world over for its simplicity and flexibility, as it can be used either as a trend or momentum indicator. Stands for Moving Average Convergence Divergence.It is a trend following momentum indicator. Moving average convergence divergence (MACD), invented in 1979 by Gerald Appel, is one of the most popular technical indicators in trading. The MACD indicator formula is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA. The MACD was created by Gerald Appel in the late 1970s. Note the inputs for both EMAs is 3-period. This crossover strategy is based on 200 and 15 EMA.

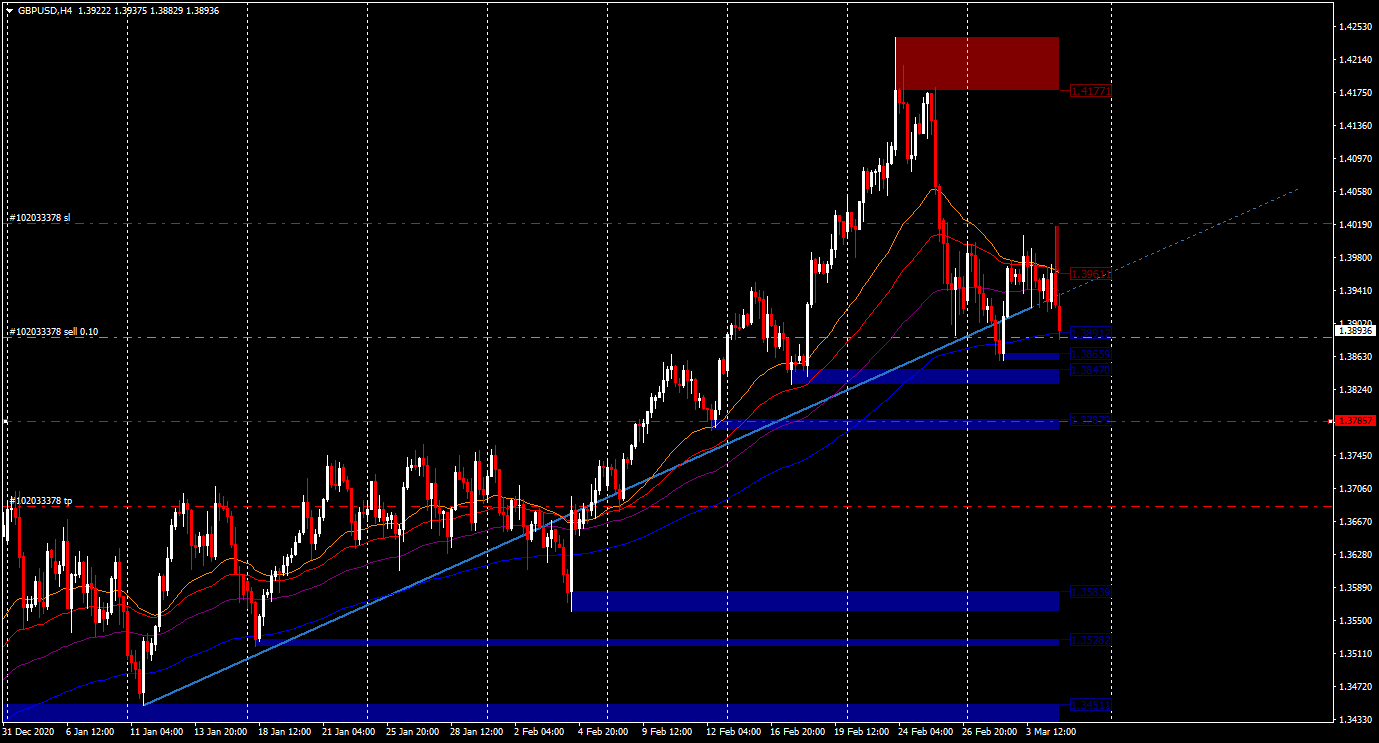

#50 ema and 200 ema strategy how to#

200 EMA + MACD Trading Strategy Tested 100 Times With 3:1 RR, Play most searched high definition online streaming videos about How to Trade 200 Ema. Due to the fact that they are lagging signs. The twist is using two exponential moving averages with the same period, but calculated using two different sets of price data, namely: The bars’ lows. The long-term 50 EMA, signaling the longer-term Exponential moving averages (EMA) provide you with a. A 50-day moving average line takes 10 weeks of closing cost information, and then plots the average. Step 2: next you switch to the 4hr chart and see where the 200ema is relative to the price. The daily chart determines the main trend.

It is a trend-following, trend-capturing momentum indicator, that shows the relationship between two moving averages (MAs) of prices. The EMA stock trading strategy can help us follow the price strength with one simple twist. Ok traders, here are the rules of this trading strategy: STEP1: first, place 200ema on your daily chart. Disadvantages of the stochastic, 200 ema indicator, scalping strategy.

MACD stands for Moving Average Convergence Divergence.

0 kommentar(er)

0 kommentar(er)